Resident companies are taxed at the rate of 24. Generally an expenditure is not tax deductible if.

What If I Don T Have Receipts For Last Year S Business Expenses Mazuma

How to claim small business tax deductions.

. Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. The tax year or year of assessment YA for individual tax runs from 1 January to 31 December calendar year.

Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million. LEGAL and professional expenses are deductible under the Income Tax Act 1967 ITA when they are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist. You will be granted a rebate of RM400.

Besides the above the Income Tax Act 1967 also specially listed down in Sec 39- deduction not allowed such as. To deduct these expenses that have benefits lasting longer than a year you would need to claim periodic deductions for amortization depletion or depreciation. 17 on the first RM 600000.

This tax rebate is why most Malaysia n fresh. A the tax treatment of entertainment expense as a deduction against gross income of a business. This means that income for the calendar year 2019 is taxable in the YA 2019.

20 of the QPE incurred. Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. Tax rebate for.

Some of the most prominent deductible corporate expenses include. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA. The legislation dealing with the general deduction is stated in Section 33 1 of the ITA.

Under section 331 of the Income Tax Act 1967 ITA all outgoings and expenses wholly and exclusively incurred during a specified period by the business in the production of gross income from a source is deductible. 14 Income remitted from outside Malaysia. For more information consult IRS Publication 535 chapters 7 and 8.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. What is the Corporate Tax Rate in Malaysia.

The Income Tax Deduction for Expenses in Relation to Listing on Access Certainty Efficiency ACE Market or Leading Entrepreneur Accelerator Platform LEAP Market of Bursa Malaysia Securities Berhad Rules 2020 the Rules were gazetted on 3 September 2020 and have effect from year of assessment 2020. Advertising expenses Salaries and bonuses. From a plain reading of section 331 of the ITA the requirements to be satisfied are twofold.

In short when you spend money to earn money youre allowed to deduct that cost from the. These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES PREFERENTIAL TAX TREATMENTS FOR PROMOTED SECTORS EXEMPTION OF IMPORT DUTY AND EXCISE DUTY Malaysia offers a wide range of. These expenses however will not be deductible if they are incurred in acquiring new rights or facilities as they are considered to be capital in nature.

To claim your small business tax deductions heres what you need to do. Expenses for the employee medical insurance and retirement plans. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production. Not wholly and exclusively incurred for the purpose of business eg. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

40 of the QPE incurred. To legislate the above-mentioned proposal the Income Tax Deduction for Expenses in relation to Listing on Access Certainty Efficiency ACE Market or Leading Entrepreneur Accelerator Platform LEAP Market of Bursa Malaysia Securities Berhad Rules 2020 PUA 263 were gazetted on 3 September 2020. Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of Schedule 3 to the Income Tax Act 1965 ITA in relation to provision of machinery and equipment including ICT Equipment except motor vehicle.

These rules and guidelines follow the proposal of the limitation in the 2019 budget 2 released on 2 November 2018 and enacted. 24 in excess of RM 600000. Tax rebate for self.

If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. 19 rows Additional deduction of MYR 1000 for YA 2021 increased maximum. In order to be eligible for PWP the expatriates salary must be paid by the overseas company.

However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply. On 28 June 2019 Malaysia issued rules the Rules on the interest deductibility limitation. 1 On 5 July 2019 the Malaysian Inland Revenue Board the IRB released guidelines the Guidelines to supplement the Rules.

Private expense Pre-commencement expenditure. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. The standard corporate income tax rate in Malaysia is 24.

If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. Malaysia adopts a current year basis of assessment.

And b steps to determine the amount of entertainment expense allowable as a deduction. Other corporate tax rates include the following. For example if you take up a job while overseas and you only receive the payment for the job when you are back in.

Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross. Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. Tax rebate for Self.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Domestic or private expenses. Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below.

The Rules apply to a technology-based.

T Glide Files How To Retrieve And Insert Filing System Office Filing System Accounting Office

Meals Entertainment Deductions For 2021 2022

13 Business Expenses You Definitely Cannot Deduct

12 Month Rule For Prepaid Expenses Overview Examples

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-05-0a18b601c53e44e29084a0b778b79723.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Learn What Bookkeeping Is How It Works And How To Use It In Business Bookkeeping Templates Bookkeeping And Accounting Financial Information

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

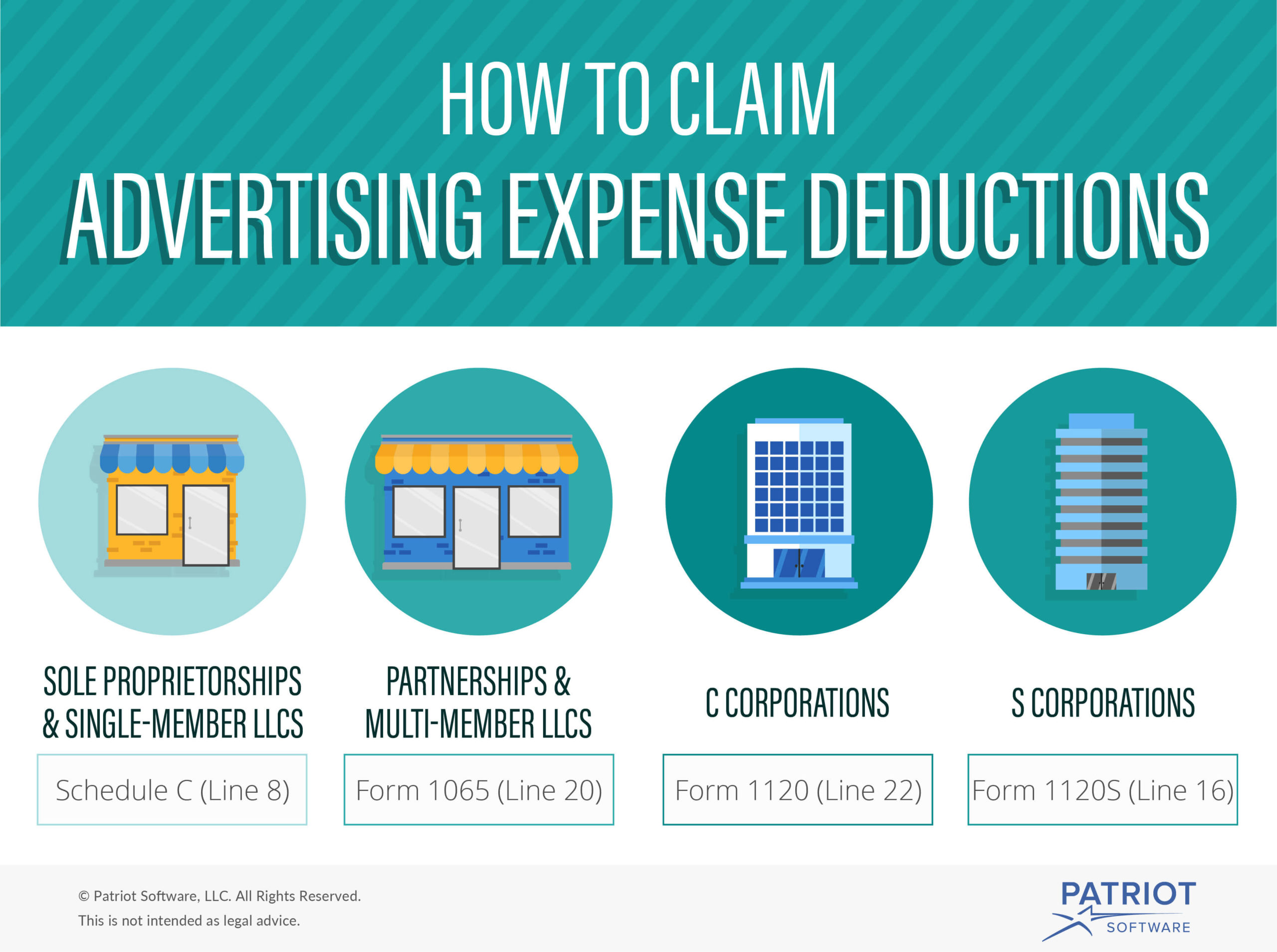

Advertising And Promotion Expenses How To Deduct For Your Business

How To Calculate Amortization Expense For Tax Deductions

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Student Loans Federal Student Loans Money Concepts

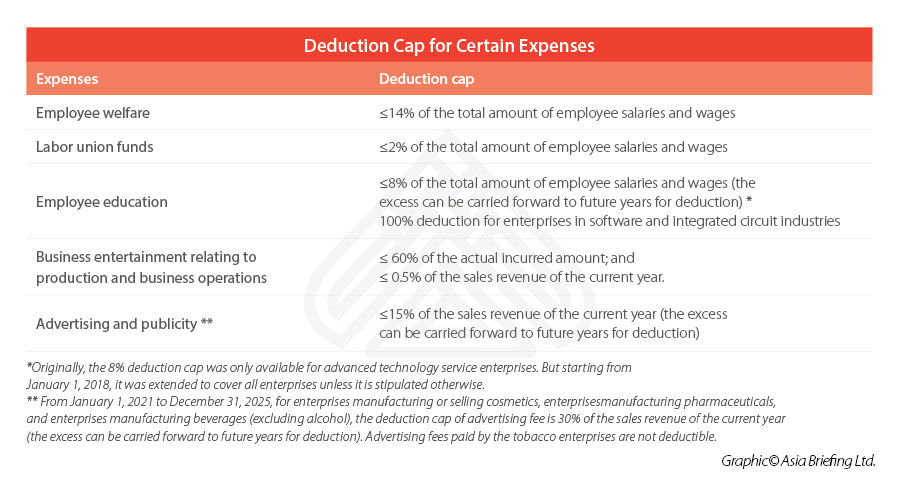

China Extends Pretax Deductions For Advertising Expenses By 5 Years

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

Cash Flow Projection Worksheet Cash Flow Solar System Projects For Kids Flow

What Are Non Deductible Expenses Rydoo

Deduction Vs Expense Do You Know The Difference

Tax Treatment For Entertainment Expenses

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)